Our AI Analyzes the Stock Market So You Don’t Have To

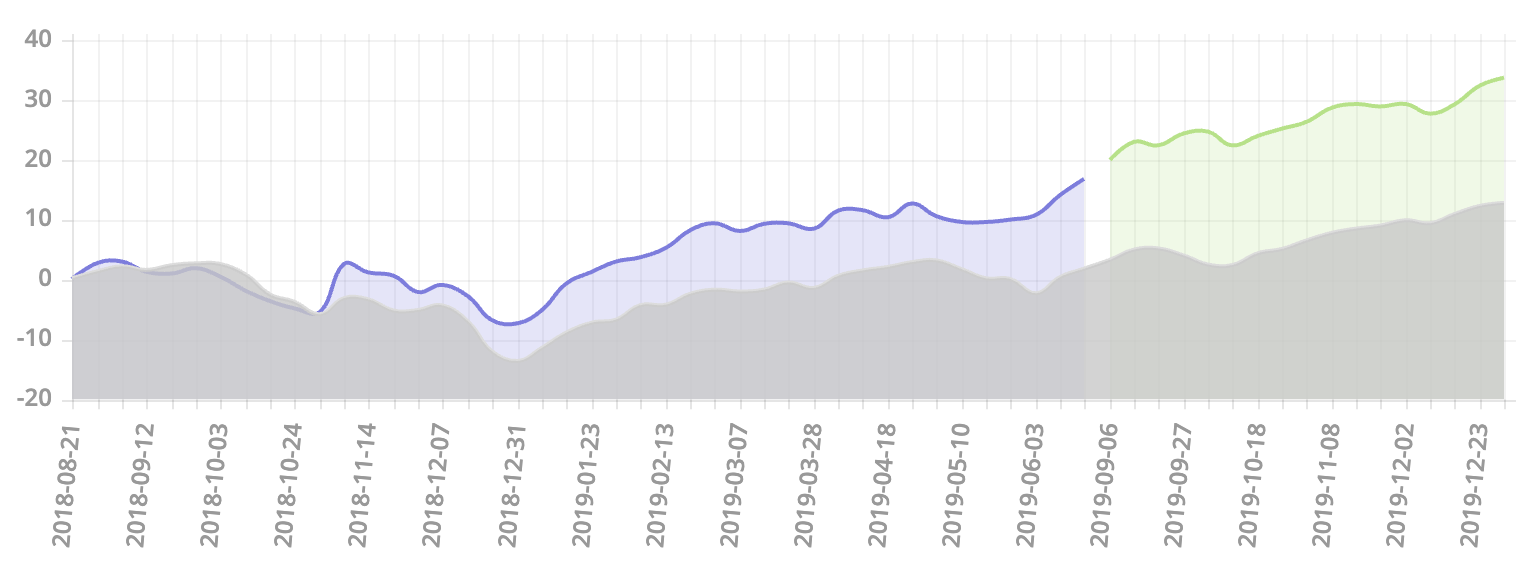

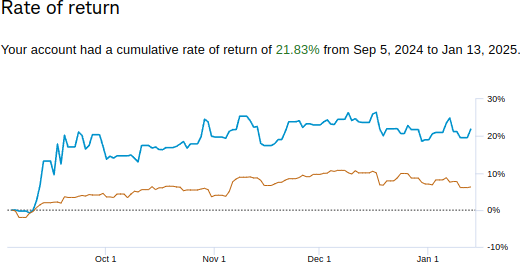

Real-Time AI Trading: 222%

S&P 500: 22%

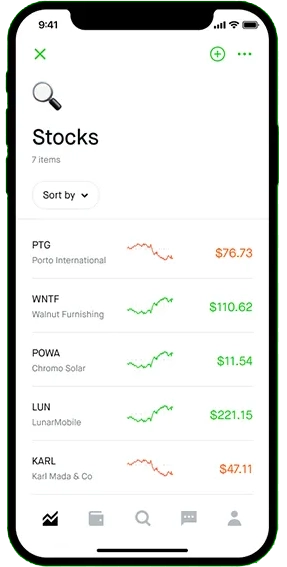

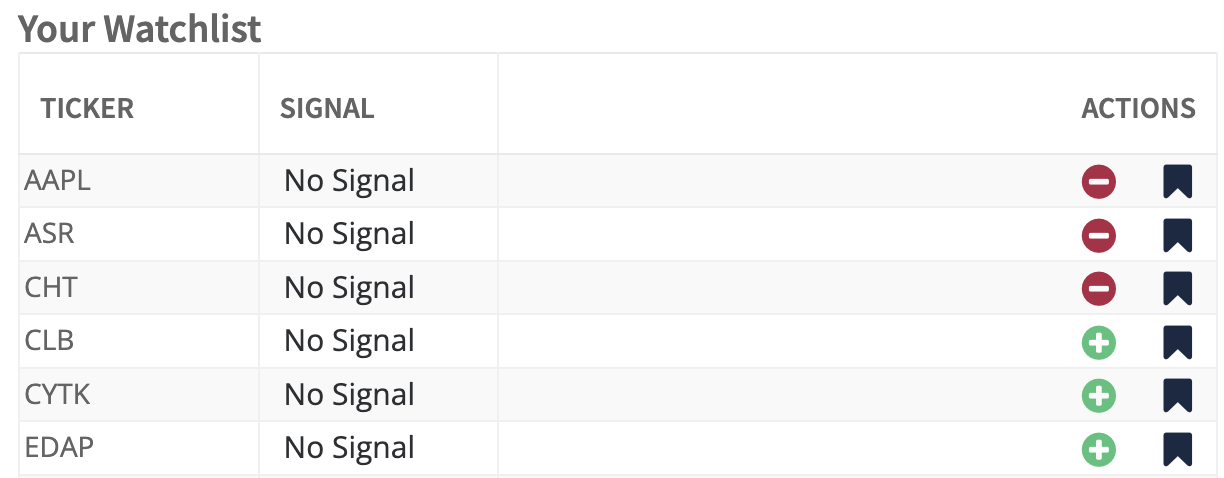

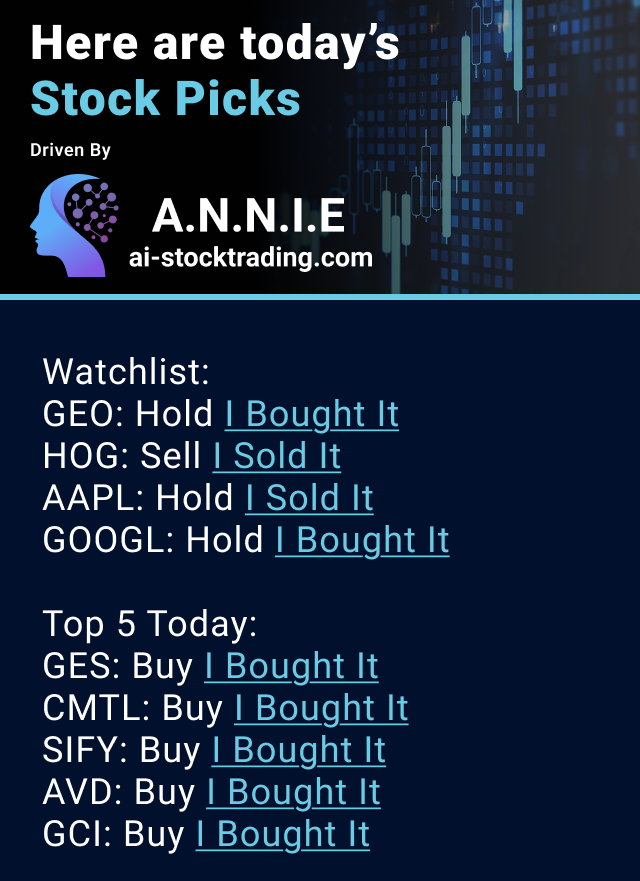

Get real-time trade alerts and daily forecasts—backed by data, not hype. AI Stock Trading is a forecasting and alert system powered by real-time data and machine learning. You get clear, actionable trade signals every day—no guesswork.

Unlock high-probability trades daily, designed to supercharge your long-term wealth building, without the endless research.

Proven with real trades executed in a live Schwab IRA account

Tired of spending hours researching stocks?

ANNIE AI streamlines your strategy, delivering expert-vetted picks directly to you, so you can achieve aggressive growth for your retirement efficiently.

Join FREE to get today's pick.

Paolo Made 80% in 3.5 Months!

I want to compliment you because I’ve been testing your picks since the end of July, and so far, they’ve achieved what I consider to be amazing performance. Around 80% in three and a half months. I’ve tried at least 10-15 of the best AI stock pickers. I can tell you that in terms of performance, yours is currently the one with the highest return!

— Paolo

Instant Profit for Jarome

I want to say I put 1k into Annie a week ago and I'm up 35%. Annie is the truth!

— Jarome

A Proven Track Record

We understand that when it comes to your investments, seeing is believing. Unlike other AI trading platforms that rely solely on paper trading results, our AI-driven strategy is proven with real trades executed in a live Schwab IRA account. Explore our historical and real-time performance data to see how we've consistently outperformed the market with actual trades, not simulations. Transparency and authenticity are central to our approach—because your trust deserves real evidence, not just promises.

ANNIE's History Trade AlongMessage from the creator:

Harnessing AI for Stock Trading

Let’s Navigate the Future Together

How-to Use our AI

Understand AI’s capability to predict stock movements, process vast amounts of data instantly, and eliminate human emotional biases from trading decisions.

Understanding AI Stock Trading

Dive into the world of artificial intelligence and discover how it is revolutionizing stock trading. Learn about the intricate algorithms, big data analysis, and machine learning techniques that power our AI-driven stock picks.

Discover Efficient Investing

In the traditional DIY stock trading world, success paints a picture of a dedicated individual pouring over vast amounts of financial news, tracking market movements, and diving deep into company prospectuses. AI is the alternative…